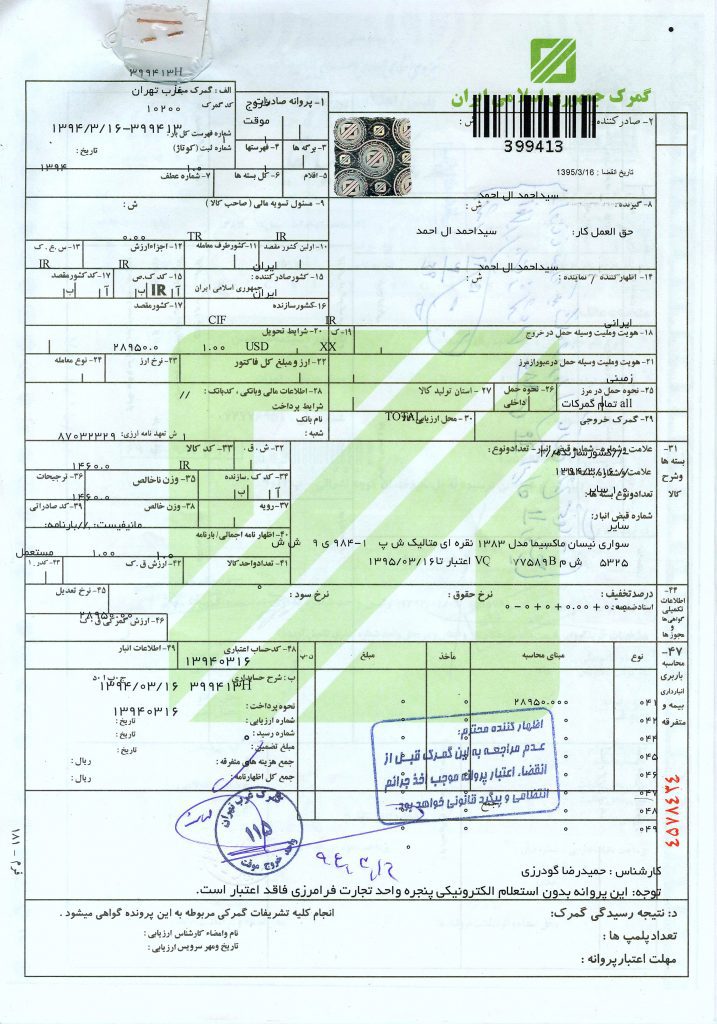

Customs Green Sheet

The customs green sheet is one of the documents that we need in the prosperous export and import market to carry out business activities correctly. This green sheet is the license that we need to get the imported goods out of the customs and without it, we will not be able to get the goods out of the customs.

People who intend to import and clear goods from customs must first submit some necessary documents to customs. Among these documents, we can mention the bill of lading and the purchase invoice of the goods. By handing over these documents to the customs expert and necessary control by him/her, a customs green sheet will be issued to the importer.

Information Entered on the Green Sheet

1. 8-digit order registration code

2. The name of the sending and importing company

3. Product Name

4. The weight of the goods

5. Number and type of imported packages

6. Warehouse receipt number

7. Bijak number

8. Date of delivery of goods

9. Cottage number

10. Original price and fees paid to customs

Green Sheet Issuing Rules

Issuance of green sheet is also affected by some laws and regulations, like other formalities related to customs and clearance. The owner of the goods or the importer must deliver all the documents related to the goods he/she intends to export to the customs. Among these documents, we can refer to the bill of lading, documents containing information about packaging, purchase invoices, certificates of origin, etc.

After submitting these documents, the next step is to file a case. In relation to imported goods that require the issuance of health permits, it is necessary to obtain the relevant permits and then deliver them to the customs along with the rest of the documents. After preparing and delivering these documents to the customs, we can receive the customs green leaf from the experts.

Customs Green Sheet Fees

Among the costs that must be paid in order to import goods, is the cost of obtaining a customs green sheet. The amounts paid in this field include two categories.

1. Tax

The tax paid in this regard includes items such as customs duties, commercial profits, duties, value added tax, and four percent of the on-account tax.

2. Cost

These costs include the amounts that must be paid for services received from transportation companies, port organizations, warehousing organizations, etc. In this regard, we can mention the costs related to unloading, loading, storage and standardization. All these amounts, that is, both taxes and expenses, can be entered in the green sheet.

Substitute for Customs Green Sheet

Today, due to the advancement of technology and the movement of business mechanisms in the direction of electronization, customs affairs are also done electronically. This approach is due to the speed of action in the field of goods clearance and also to prevent smuggling and counterfeiting.

With the electronicization of the formalities related to customs affairs, it is possible to register the necessary information and issue a green card online without physical presence. With the issuance of an electronic green card, a card with the title of clearance order is issued to traders and franchisees, and by presenting it to the customs authorities, the goods in the warehouse can be inquired about and cleared.

Customs License

The customs license is the last administrative step necessary for the clearance of goods from customs. Issuance of this permit by the customs means that the product evaluation process has been completed and the full settlement of the goods owner’s account with the customs has been done and now he can proceed with the clearance of the goods from the customs. This license or customs license is issued for all goods, both commercial and non-commercial, and it is not possible to clear the goods without it.

Up To Sum

In order to clear imported goods from customs, we need to present some documents to the customs department and receive a customs green card or clearance order. There is no possibility of clearance without control, supervision and issuance of green leaf related to the import of goods by customs experts. Any action contrary to this process will be illegal and subject to the title of smuggling.