Capital Analysis Methods

Capital analysis methods are used for investing and entering the stock market. In order to make a successful investment in various fields, especially trading in the stock market, we need to be familiar with various analyses. These analyzes provide us with the opportunity to get to know and recognize suitable situations for investing in the stock market. Familiarity with all kinds of analytical methods helps us to walk with full knowledge in the path of investing and buying and selling stocks and achieve maximum profit with minimum capital.

Types of Capital Analysis Methods

For capital analysis, we are faced with 3 methods of technical analysis, fundamental analysis and panel reading analysis. The choice of each of these 3 methods is made according to the interests and personality characteristics of each investor or trader.

1. Fundamental Analysis

Fundamental analysis is based on the fact that each security has its own intrinsic value. To make a decision about buying and selling each sheet in the market, we must compare its inherent price with its current price in the market. In this case, if the current price of the sheet in the market is lower than its intrinsic value, buying it seems logical, otherwise it seems irrational. To know the intrinsic value of each share, we examine the company’s fundamental data, such as the amount of production and sales, as well as the amount of profit and loss. A fundamental analyst is required to obtain such data by examining the underlying financial statements of the company.

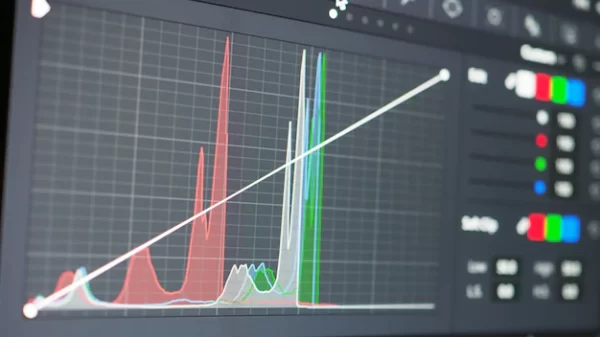

2. Technical Analysis

In the technical method, the analyst seeks to examine the charts and pay attention to the price fluctuations of an asset from the past to the present in order to be able to predict the future of the asset. Every technical analysis includes 3 important principles:

– The price says everything.

– The trend of a commodity determines the prices.

– History can be repeated.

Due to the focus that technical analysis has on the charts of a share and the use of technical analysis tools, it is also called chart analysis. The limitation that the technical analysis system has in this regard is in dealing with the shares of a new company. A company that has a new presence in the capital market will not have a significant chart to check the trend of price fluctuations from the past until now. Therefore, it is not possible to predict its price situation in this way. But in this regard, the fundamental analysis capabilities can be used to analyze the future state of the company’s shares.

3. Board Reading

In reading the board, we examine and evaluate the information written on the board of a share. The purpose of this action is to analyze the transactions made in the desired share. These transactions include buying and selling of real and legal shareholders, share price, volume of transactions, etc.

Advantages of Fundamental Analysis

1. Absence of prejudice and personal bias.

2. Analysis of the economic situation of a share in the long term.

3. Accurate calculation of the value of an asset.

Disadvantages of Fundamental Analysis

1. Time-consuming study and review of relevant documents.

2. The impossibility of accurately determining when the stock will reach its intrinsic value.

3. The impact of unexpected factors such as political changes or changes in laws.

Advantages of Technical Analysis

1. Access to information without delay.

2. Detecting the exact time of entering and exiting the market.

3. No time limit in the analysis.

4. Obtaining information about the amount of supply and demand, which leads to knowing the market’s desire.

Disadvantages of Technical Analysis

1. The possibility of risk in the long term due to not paying attention to fundamental factors.

2. Confusion due to receiving conflicting signals.

Up to Sum

Achieving success in the field of investment and stock trading does not happen by chance. Familiarity with capital analysis methods is necessary and essential for working in the stock market and succeeding in it. The choice of analytical methods depends directly on the trader’s needs and the type of transaction. However, it is necessary to be familiar with all analysis methods. Because the areas of investment are diverse and wide, and in relation to each one, we must implement the appropriate method.